Nationwide Insurance Information

The first important thing to remember in terms of home insurance is that you don't need to take out any secondary land insurance to secure your home from loss, damage or liabilities. Their is no need to insure your land on which you plan to build your home. Typical home insurance already covers damage, theft and losses that may occur, that being said; insuring your land separately with your home insurance is considered unnecessary and would not claim any benefits but rather lead to an unnecessary expense.

The second important thing you might neglect while investing in a new home is home security. Having your home equipped with a reliable security system would actually help you save money with your insurance company. Security coverage such as motion detection alarms or outdoor security lighting systems would reduce the chances of theft which in turn makes your home secure and may reduce the overall cost of your home insurance.

An important item to check regarding safety in your home is a smoke alarm system. In fact it has become mandatory in many states to have a smoke alarm detection system installed when you purchase a new home. It is suggested that you annually check or replace your battery in your system to ensure that you are being protected in case of a fire. Having a faulty smoke alarm system can result in conflict with your insurance company. If anything should go wrong, you may remain liable for it as you are responsible to keep your security equipment up to the standards. In the long run, regular maintenance of your equipment and avoiding a claim may save you money in home insurance premiums.

For security measures and general safety, it is a good idea not to leave ladders, tools or shovels openly available outside your home. These items are an open invitation to burglary as they provide easy access for break-ins. You can prevent theft due to negligence by being careful with items around your property. Always put them away after usage.

An important addition to making your home more secure would be to have dead-bolts locks in the main entrance points of your home. This would make break-ins a difficult challenge and also keeps you protected from any criminal acts. The more secure you make your home, than the smaller the chance of making an insurance claim. This would keep your insurance premiums down and make insurance payments more affordable.

For more tips and information regarding Affordable Home Insurance, visit Affordable Insurance for your source of insurance information, safety and tips.

Nationwide Mutual Insurance Company & Affiliated Companies is a group of large U.S. insurance and financial services companies based in Columbus, Ohio. The company also operates regional headquarters in Des Moines, Iowa, San Antonio, Texas, Gainesville, Florida, and Lynchburg, Virginia.

Nationwide Financial Services, a component of the group, was partially floated on the New York Stock Exchange prior to being repurchased by Nationwide Mutual in 2009. It had owned the majority of NFS common stock since it had gone public in 1997.

The Companies

Nationwide is one of the largest insurance and financial services companies in the world, focusing on domestic property and casualty insurance, life insurance and retirement savings, asset management, and strategic investments.

History

Beginnings as Farm Bureau Mutual

On December 17, 1925, the Ohio Farm Bureau Federation incorporated the Farm Bureau Mutual Automobile Insurance Company in Columbus, Ohio. At that time, Ohio law required 100 people to pledge to become policyholders. The first agents managed to recruit ten times that number, and on April 12, 1926, Farm Bureau Mutual started business with 1,000 policyholders.

The first product of the new company, as its name implied, was automobile insurance. The company wrote policies only to Ohio farmers. In 1928, Farm Bureau Mutual began offering policies to West Virginia farmers, followed by Maryland, Delaware, Vermont, and North Carolina. Farm Bureau Mutual began underwriting residents of small towns in 1931, and residents in larger cities in 1934.

Expansion

Also in 1934, Farm Bureau Mutual began offering fire insurance. This product grew the following year with the purchase of a struggling fire insurance company. With growth came a need for expansion of office space. In 1936, the company moved to the famous 246 Building at 246 N. High Street in Columbus. By 1943, Farm Bureau Mutual operated in 12 states and the District of Columbia. Even with the tripling of space in the 246 Building (which was finally dedicated on the 25th anniversary of the company), Farm Bureau Mutual still had insufficient office space, and began opening regional offices in 1951.

In 1955, Farm Bureau Mutual changed its name to Nationwide Insurance, a name by which it's commonly known today. In the 10 years that followed, Nationwide expanded into Oregon, making the company truly "nationwide". It also expanded into 19 other states, bringing the total by 1965 to 32 states and the District of Columbia.

Nationwide outgrew the 246 Building by the 1970s and work began on a new skyscraper headquarters for the company. In 1978, One Nationwide Plaza was completed at the southwest corner of N. High Street and Nationwide Blvd. on the northern edge of downtown Columbus, Ohio. Since 1978, Nationwide has added the following to its presence in Downtown Columbus: Plaza Two (on the northeast corner of High Street and Chestnut), Plaza Three (just west of High Street and Chestnut), Plaza Four (Front Street), and 275 Marconi (behind Plazas One and Three on Marconi Blvd) which together with Plaza One form the primary downtown complex. In addition to downtown Columbus, Nationwide also has a significant presence in the suburbs of Dublin and Grove City.

Nationwide currently has about 36,000 employees, and is ranked #100 in the most recent Fortune 500.An important meeting is being held with all PCIO employees in small groups. It was the combination of many VPs input about where this company is and what the future looks like. It is a good meeting, and I agree with a good bit of it. They are saying a lot of good things that I agree with, but the future is still pretty murky. Now is a time of great change at Nationwide. We need more talent. We’re a catamaran careening through the corporate waters of the world. We’ve pretty much won the claims adjusting battles and now our main competition is pricing segmentation and marketing. The strategy map session laid down some of the priorities looking to the future. It appears that senior leadership is more optimistic about this company than ever. And our recent benefits cut-backs (Your Time and changes to the retirement plan) actually dove-tails with their optimism (that landed like a lead-balloon). Anyway, the sessions emphasize that Nationwide has to Grow, Evolve, and Change. Hopefully Grow as in grow into new markets. We’re at a strange corporate moment: due to our omnipresence in all things hurricane, we have a super high profile. How can you be loved and respected by your customers and users? You have to deny claims that are not covered, like storm surge/flood claims. You’re the lumbering big-bad insurance company, and these wonderful folks have you protecting their homes, cars, and lives. Perhaps even their mortgages and investments. Every flaw ripples out to a chaotic echo chamber of grumbles. Every scrappy competitor wants to take you down, and thanks to car owners lying about who they live with or let drive their cars, it’s not too hard to create bad scenarios. We’re a successful company encumbered with billions of dollars. We’re on a Trustworthy-Insurer Trail of Tears. Anyway, back to the strategy map meeting: They pointed out that premium growth (our big source of money) is disappearing in FY05. That’s a-gonna make things rough. We’re trying to cut back expenses first of all. (Lots of folks who had it easy and that were enjoying weekly shrimp parties are going to have to start eating cold weenies.) Beyond the corporate buzz-word rah-rah (Excellence! Accountability! Satisfaction!) there were a few other interesting highlights:

Growth in Non Standard Auto and Commercial will continue.

Progressive pricing vs. Nationwide pricing: it will take time for perception of Nationwide being too expensive in comparison to turn.

Goal Sharing will remain! Yea! Though Florida, Mississippi, and Texas can kiss it goodbye for 2005. Boo!

Good question about what we’re doing for employee career development really didn’t get answered. So this is where the leadership is indicating how it is incredibly important that employees grow but then sort of pat you on your back and say, "And good luck with that!"

What markets can we grow into? The strategy session didn’t really answer that, though they’d be happy if Allied and THI grew by 10% (hell, so would I). Well, they did call out some markets we’re targeting. But it seems like they're targeting markets without any solid marketing campaigns. It's like we expect the customers to say, "OK, you don't have a cute lizard, duck, or even Snoopy. But since your agent goes to my church, I will buy your coverage."

I’ll be interested in seeing where this expressed vision goes, plus what happens with it between now and the upcoming company meetings.

Nationwide! Nationwide! On Your Side!

Why a weblog about Nationwide Insurance? This is a weblog written by someone working for change at Nationwide. I’m working for change from the inside (you don’t get to see that, most likely). And I’m working for change from the outside (yes, this right here). I intend to use this area to post one NWer’s view of what is going on with this company and what opportunities exist to shine. Thanks for reading this and I hope you’ll return in the future. Please subscribe to the feed! You’re not only obviously incredibly good looking but also exceptionally smart. Please share with me your input about what I say here plus any insight you might have. What kind of things do I intend to post about? Oh, let’s see:

Nationwide needs to improve its marketing campaigns. They're too boring and ineffective. It doesn’t need an entertaining mini-movie commercial. No, it needs to get itself a corporate mascot that is recognizable and endearing. Think GEICO gekko or AFLAC duck.

Nationwide needs to offer competitive compensation to attract the best people. It’s hard enough finding the scarcest of treasured corporate resources: the talented individual suitable for working at Nationwide. Stop making the company unpalatable to the most talented and reward those precious scare employees inside so that they are inspired to be more productive and provide service that delights our customers.

Continue the community effort and make it so that every department is dedicating some time per week helping out in the community, sharing all that wonderful knowledge between your ears. Reward that!

Back to Basics. Great coverage at competitive prices with world-class customer service. Bread and butter.

Re-energize the home-owners market. The home-owners market is pretty tepid with-respect-to Nationwide -- with the company pulling out of Florida and facing large losses from Katrina. It can’t take that much effort to invigorate Nationwide for the home-owners customers in less hurricane-prone markets. Plus, all of the TV footage of the CAT adjusters on duty in Florida and Mississippi would make for great advertising and PR campaigns. Make it cool to have Nationwide on your side.

Start working vigorously on multi-lines customers again. Battling the auto insurance wars, dusting off our hands, and running away screaming that we can't match the rates from GEICO and Progressive represents the very worst in less-than-competitive behavior.

I LOVE THIS COMPANY! Nationwide! Nationwide! Rah! Rah! Rah!“Nationwide is outspent by most of our competitors, so this campaign will leverage on-line and viral media in a huge way to give fans a chance to learn more about our legendary pitchman and hopefully build a dialogue with Nationwide about how our personalized customer service can make their insurance experience better. The World’s Greatest Spokesperson in the World will be an advocate for consumers, listening to the things about insurance that frustrate them, and then challenging Nationwide to address these concerns.”

Aside from the WGS campaign, Nationwide has a healthy and dedicated following across the social web. Their choice to accept and respond to criticisms on the Facebook fan page shows they are transparent in their use of social media and not trying to force feed messages while ignoring feedback.

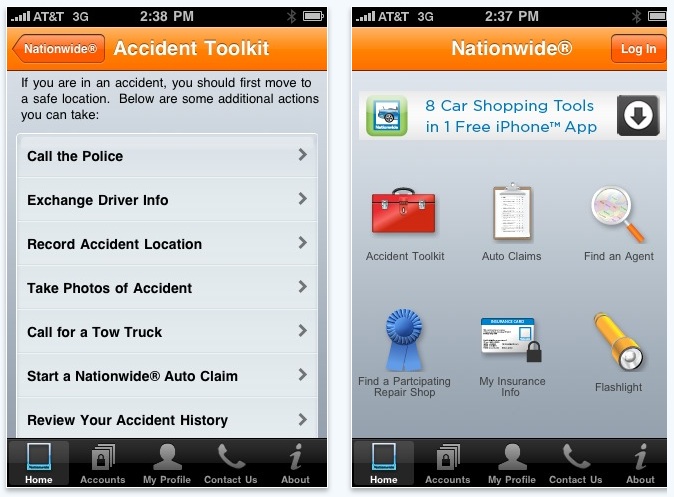

Nationwide’s social media program goes deeper but two other areas of focus are the strong partnership with NASCAR and an iPhone app called Cartopia which helps people, “Make car shopping a little easier and fender benders a little less of a hassle.”

If your agency is affiliated with Nationwide, they’ve provided some compelling content for you to build off of. The insurance provider is breathing humor into insurance and my guess would be they’re hoping some of their own agents will adopt the World’s Greatest Spokesperson’s mentality and become the World’s Greatest Insurance Agents.

No comments:

Post a Comment